Income tax return filling for FY 2015-16 has been started. Some major changes in income tax return form for FY 2015-16 have been introduced by government of India. It increases burden on Taxpayers on some extent but will increase transparency We will cover all these changes in this post.

Changes in income tax return form for FY 2015-16:

Introduction of NEW ITR 2A form :

New form ITR 2A is introduced for individual / HUF to report income other than capital gains, business income, foreign income or foreign asset or who is not claiming relief under section 90, section 90A, section 91.

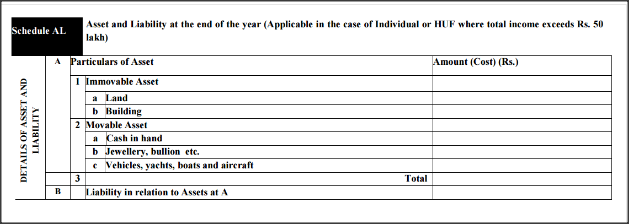

Schedule AL – Disclosure of Assets and liabilities:

Now, assessee is required to disclose assets and liabilities in income tax return. Don’t be scared ! This change is applicable only to assessees whose annual income is more than Rs. 50 Lakhs.

This change is introduced by additing schedules in ITR 1, ITR 2, ITR 2A, ITR 3, ITR 4 and ITR 4S.

You can see schedule AL in income tax return form in below pic. Click to see it large.

Since foreign assets and income are separately reported in Schedule FA, it appears that Schedule AL will capture details of those assets that are not captured under Schedule FA, i.e., India assets.

Assets to be reported include immovable assets, cash in hand, jewellery, bullion, vehicles, yachts, boats and aircraft at cost. Financial assets like stocks or funds are not included. Valuation report is not required. If an asset was received by inheritance or gift, it would be required to be reported at cost to the previous owner of the asset with improvement cost. This provision is substitute of wealth tax provision which has be abolished.

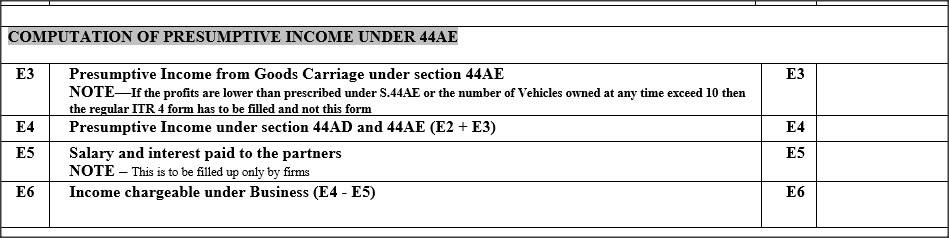

ITR 4S and Partnership firm

There is good news for partnership firm for FY 2015-16. Partnerhsip firms can file ITR 4S and use presumptive taxation under section 44AE and Section 44AD. To adapt sections, partnership firm should provide salary and interest paid to partners. Read full post on presumptive taxation here.

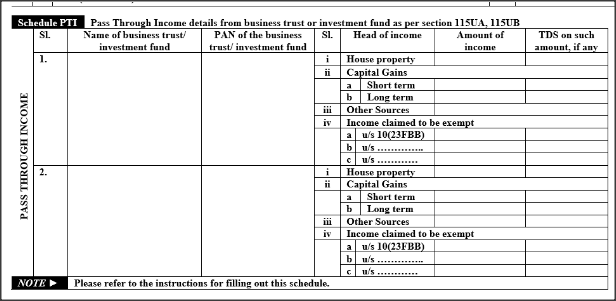

Schedule of Pass Through Income ( PTI) in New ITR Form :

New schedule of Pass Through Income is Inserted in all the ITR forms expect ITR 1. This schedule is inserted to capture details of income from different sources by investors in venture capital funds or real investment trusts.

Income distributed by funds is taxable directly in investor’s hands. The funds are required to report to income tax department. Reporting by investors will help the tax authority reconcile data and track defaulters.

Schedule IF in ITR 4:

Schedule in ITR-4 requires information about the partnership firm in which taxpayer is a partner. The taxpayer is required to report name of firm, profit sharing ratio, capital balance, international transaction details.

Schedule TCS:

When purchasing jewellery worth Rs. 6 lakhs in single transaction, he needs to pay TCS at 1% over the purchase price. Taxpayer can claim credit of TCS collected by seller. Schedule TCS is to show amount of tax collected at source. Purchaser has to show jewellery in AL schedule.

This were the changes brought by government to increase transparency and more reporting in income tax return. I hope this will help in curb black money. If you have confusion about income tax return filling or want to avoid notices, you can get help of our team of CAs to file your return. Click here to start.

If a person sells his inherited property, which comes by way of will , along with other family members, . Please clarify whether it attracts capital gain or not.

Yes, capital gain is attracted. Cost to previous owner will be considered as cost of acquisition.

Madam I have left my job on 31 Mar 2016.from 01 Apr 16 on ward my income will be only intrest income of about 150000 pa .am suppose to file income tax return

Ialso have rental income of about 75000.I’m senior citizen.do I have to inform income tax authority? Pls advise Mrs darshana

Mam,

No need to file income tax return as your total income is less than basic exemption limit.

Thanks,

Tarannum

I am running 67. retired person. Getting Rs 30,000/- per month. After deduction of 10% TDS am getting actually 27,000/- . also getting a pension of Rs 1000/- . How to avoid TDS payment.

if any legal route is there Please detail me madam. Being a senior citizen, I feel that I am getting below the Taxable income and I need not pay any IT.

Sir,

You cannot avoid TDS deduction but you need to file return to get back refund.

Total refund will be tax liablity less tax deducted.

A contractor is doing canteen services in club by paying monthly rent to the club.please tell me whether it comes under indoor catering or outdoor catering

Sir, it is indoor catering.