Introduction to e-Invoicing

The Government has introduced the system of standardized reporting of B2B Invoices to the GST System, termed as ‘Electronic Invoicing’ or e-Invoicing under GST. Implemented on a voluntary basis from Jan 1st, 2020, and as a compulsion from April 2020 for Businesses having annual,aggregate turnover more than 100 Cr.

As per the rule, the generation of Invoice shall be done in a specified format, from the ERPs and uploaded/reported on a unified official site called Invoice Registration Portal (IRP). For each E-Invoice a unique Invoice Reference Number (IRN) and a Quick Response (QR) Code will be generated and printed on the E-Invoice.

Additionally, Businesses having an annual aggregate turnover of 500 Cr must generate QR Codes for their B2C Invoices.

It is being anticipated by Tax Officials that e-Invoicing may become one of the most successful branches of the GST System. Its objectives are designed to benefit both the Taxpayer and the Government in numerous ways.

The basic thought process behind e-Invoicing is to curb tax evasion as well as to make GST filing and compliance easier for the tax-filers. This objective is fairly achieved by the e-Invoicing System.

Initiation of e-Invoice has made the process simpler and reliable both for compliance and reconciliation.

Although, contrary to what the name suggests, the B2B invoices are not the only documents to be reported on the IRP, other documents like, the B2G Invoice (Business to Government), Credit Notes, Debit Notes, Export Invoices, and Reversed Charge Invoices must be reported on the IRP too.

The Objective of the concept – e-Invoicing

The thought behind e-Invoicing seems thorough and logical, it is highly object-oriented. The major concerns of the Government at this point are Tax frauds, evasion & stealing by surreal claims of Input Tax Credits, using bogus invoices.

Other than the technical aspects, the Government aims at easing the process up for taxpayers using technology.

Stated below are the objectives of e-Invoicing System-

- Depletion of Tax Evasion- To reduce the count of tax frauds to a negligible figure. This is possible using e-Invoicing since it slims the chances of Fake Invoices that leads to false Input Tax Credit claim.

- Systematic approach- The generation of E-Invoices in a standardized format (SCHEMA) enables the readability of the invoice by any other software. And the reporting of the Invoices on a unified portal helps all the members of the supply chain to have access to the information, at a single site.

- To Ease up the Return process- Auto-population of the details of the Invoices in ANX-1 & ANX-2 of the new upcoming GST Returns, E-Way Bills and other important documents.

- Compliance- Overall reduction in the compliance load, due to availability of relevant information at reach, under one roof. Especially for Input Tax Credit claim since the information is sent both to the Tax Department & the Buyer.

- Ease of Access- Making the information available on a unified portal where any participant of the transactions can access it on a real-time basis.

- Smoother Reconciliation- Simplified reconciliation and data verification in the various GST return comparison reports.

- Reduced Errors- Introduction to the technological advancement & automation of the process eliminates the chances of errors and mistakes made by manual data entry.

- Reduced Audits- The possibility of Tax audits is hereby reduced since all the relevant, real-time details are available to the Tax Department from the IRP.

Barriers within e-Invoicing

Despite having a firm and logical motive, the e-Invoicing system fails to provide a solution to certain questions.

The solutions to these problems are expected to be provided by the Government over time, but as of now, the e-Invoicing System does not have any other way around them.

- Changes & Cancellation- Errors rectification is not possible in an already generated E-Invoice. Even for the slightest changes, the E-Invoice must be canceled and regenerated. Further, the E-Invoice can only be canceled within 24 hours from the IRP. Post 24 hours the cancelation needs to be done manually.

- ERP Changes- In order to comply with the new format SCHEMA, Businesses must integrate their ERPs with GSPs & ASPs. Or there need to be changes & customizations in the ERPs to comply with the same. These changes may not be favorable to all the businesses.

- Bulk Generation- A big Business will have a thicker volume of transactions and hence more Invoices &E-Invoices. However, the IRP right now can only generate one Invoice at a time. This is a potential problem in the process. For now, the ERPs can be customized accordingly.

- Yet another point to be noted is the impact on e-Way Bill. The details auto-populated from a faulty canceled invoice, into an e-way bill may or may not get canceled.

The e-Invoicing System, as presumed, can be a successful measure, provided the small details are taken into consideration.

Generation of E-Invoices & Issues that tag along

The E-Invoice as per the process needs to be generated within the ERP System in the specified format, and then to be uploaded in the IRP one at a time. As of now, it is majorly suggested that the E-Invoices be uploaded in real-time, for a better track and to avoid confusion later.

But the same can also be done at a later time prior to the GSTR filings.

The step-wise process to generate and upload the E-Invoice to IRP is mentioned below

- Reconfigure the ERP as per the PEPPOL (Pan-Europe Public Procurement On-Line) Standards, and assure that it is compliant with the schema format and has all the mandatory fields as per the rules.

- Generate a normal invoice from this modified ERP in the schema format, recheck whether all the mandatory fields are filled.

- Download the JSON File of the invoice created.

- Upload the JSON File on the IRP, the IRP will then validate the file for errors or duplication.

- If the invoice is error free, the IRP generates a unique IRN, Invoice Reference Number and QR Code, and digitally signs the E-Invoice. The JSON File of this E-Invoice can be downloaded by the taxpayer and used further.

Notes- The information in the invoice is then sent to the E-Way Bill and the GST Portal, which then in return auto-fills the details in the ANX1 of the Seller and the ANX2 of the Buyer of the GST RET1. The same information can be accessed by the Tax authorities if required.

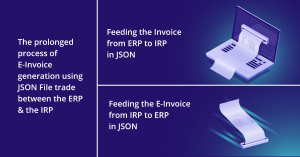

The process seems short and simple but on the contrary, it consumes time. The filing of details, then converting to JSON File and then uploading it to the IRP is not very convenient if the business is big and has multiple transactions going on, leading to working on multiple invoices simultaneously.

The process involves constant switching from the ERP with the Invoice to the IRP and back from the IRP with the finished E-Invoice to the ERP, in the JSON File format. This may look simple but actually is complex and time consuming. The management and maintenance of the JSON is an additional task to the process.

Again the invoices can be uploaded one at a time only, which is a major issue for big businesses. The same can be dealt with, up to an extent, through GSPs (GST Suvidha Provider) and APIs (Software providers).

The Overcoming the-Invoicing problems in a click

The process of generating and reporting of e-Invoicing under GST on the IRP can be shortened with the help of GSPs & APIs. GSPs being Government-authorized solution providers and APIs also being apps & software providers for GST.

One such GSP is GSTHero which simplifies GST and related processes. Its E-Invoice solution beats away the lengthy process of e-Invoicing by acting as a plug-in to integrating the IRP with your ERP. This eliminates the juggling of the user from his ERP and IRP.

TALLY & SAP Integration- It provides Direct integration within Tally and SAP using a connector or plug-in which gets integrated into both the ERPs.

Its API is also a compatible partner for other Billing systems and ERPs like MARG, ORACLE, MICROSOFT, etc. and other custom ERPs by providing customization solutions as per the changing GST Trends.

The process to generate E-Invoice in a click from Tally is given below-

- Integrate Tally ERP with Tally Connector

- From Gateway of Tally click on Invoicing

- Login using Credentials

- Create a sales entry normal Invoice

- On saving the invoice ‘Want to generate E-Invoice’ box pops- click on YES

The E-Invoice and IRN will be generated and would be printed from the same screen.

The process to generate E-Invoice in a click from SAP is given below-

- Integrate SAP with plug-in

- Enter the Company & plant code, then select a date range on the e-Invoicing interface

- A sheet appears with all the details of Invoices in the date range

- Select invoices (multiple) to be made into E-Invoices, click on ‘Generate E-Invoices’

E- Invoices are generated for the selected invoices with IRN and QR. If the data in invoices are incorrect the errors are highlighted and suggested solutions are given.

Apart from the available plug-ins, It provides custom solutions to other ERPs as well. The software and the integration make the working simpler and more flexible to bend accordingly with the constantly changing trends in GST.

The integration is simple, does not require in-depth system changes, and takes less time to set-up.

It reduces time consumption and efforts put in dealing with JSON files while generating E-Invoices. Downloading Invoices form one site and uploading it on the other & again downloading the E-Invoice in the JSON File and converting it back.

What makes the software a sight of big relief is the fact that all the E-Invoice related operations can be performed from within the ERP without going to the IRP or any other portals for the matter. The generation, cancellation, validation, rectification of errors and printing of IRN & QR code is all done then and there in the ERP.

The software provides a simple and efficient solution for complex GST problems.

Author Bio- This is sponsored post from GSTHero- E-Way Bill Generation & E-Invoicing Software in India. Visit GST Hero website to know more about the company.

Note: We accept guest post on our site. Visit sponsored post page on our website.