Advance tax is required to pay if income tax liability of any taxpayer is more than Rs. 10,000. Following easy steps can help you in advance tax payment.

- Know the due date of advance tax payment and minimum installment.

- Calculate the advance tax.

- Pay the advance tax online or offline.

Due date of advance tax payment:

There are different due dates for advance tax payment for different assessee. Advance tax is required to pay in installment.

Due date for non company assessee:

| Due date | Installment |

| On or before 15 September | 30% of advance tax liability |

| On or before 15 December | 30% of advance tax liability |

| On or before 15 March | 40% of advance tax liability |

Example:

| Due date | Installment |

| On or before 15 September | 6000 |

| On or before 15 December | 6000 |

| On or before 15 March | 8000 |

Due date for company assessee:

| Due date | Installment |

| On or before 15 June | 15% of advance tax liability |

| On or before 15 September | 30% of advance tax liability |

| On or before 15 December | 30% of advance tax liability |

| On or before 15 March | 25% of advance tax liability |

Payment of advance tax when there is capital gain during the year:

Advance tax for capital gain is required to pay in the following due date for the period when capital gain arisen. Suppose capital gain is incurred in 1 September. In this case, advance tax for full capital gain is required to pay on or before 15 September.

Calculation of advance tax:

Now, you are aware of advance tax installment. But you are also required to know your actual advance tax liability.

Calculation of advance tax is easy. Show following table for it.

| Total income of the five heads of income tax |

| Less brought forward losses |

| Less deduction under chapter VI-A deductions like LIC premium, housing loan investments etc. |

| Add surcharge if applicable |

| Less relief u/s 89 |

| Add education cess @ 3% |

| Less MAT credit |

| Less relief u/s 90,90A, 91 |

| Less TDS/TCS credit shown in Form 26AS and form 16/16A |

| Net Advance tax payable |

Payment of advance:

You can pay advance tax online or offline.

Online payment of advance tax:

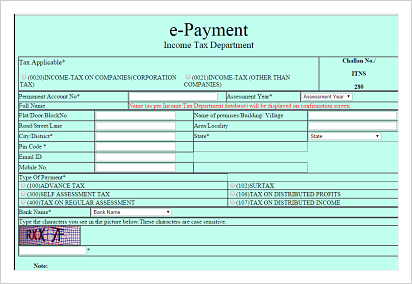

- Go to link TIN Nsdl.com

- Click to pay tax online.

- Select challan ITNS 280

- Select 0020 for companies assessee and 0021 for non company assessee.

- Fill your contact details and assessment year.

- Select advance tax 100 code.

- Select bank through which you have online net banking facility and you want to pay tax from.

- After clicking proceed, you can see confirmation screen.

- Confirm all the details and you will be redirected to your bank site.

- Pay the tax using your net banking login password.

- After successful payment. Receipt will be generated.

- Save the receipt.

- You can check advance tax payment status from oltas link.

How to pay advance tax offline?

Advance tax can be paid through physical challan. Use challan 280 for it. You can save challan 280 from the end of the article.

Remember that for auditable parties and company it is mandatory to pay tax online.

Fill the details of challan and submit it to authorized bank with tax amount. Bank will give receipt which contains CIN number. You can check payment status through CIN online through oltas.

Recommended read:

Conclusion: Select the installment applicable to you, calculate advance tax and make payment of advance tax. Isn’t it easy to pay advance tax? Have you any other question on this topic? feel free to ask. Don’t forget to share this article with friends on social media.