The CBDT has extended due date (last date) for payment of TDS for the month of September, 2014. Today is the last date. TDS can be paid by offline or you can do online TDS payment.

How to make online tds payment?

If you have software for tds return, there is no much worry because software gives all facilities from tds calculation to tds payment and filling of tds return. If you don’t have, no need to worry. You can do e payment of tds very easily.

Due date for payment of tds:

TDS deducted during the month should be paid by 7th day of the following month. Else you are liable to pay interest at 1.5% p.m. or part of month on TDS amount.

Steps for online tds payment:

Step 1: calculate the tax deducted by you during the month. Segregate it as per section under which you have deducted the tax. There is specific accounting head for different payment.

List of accounting head for different payments are in attached file in the post.

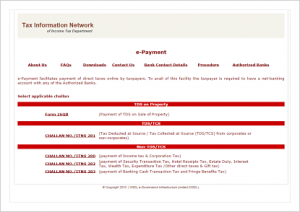

Step 2: Go to Online tds payment link. You can see following screen. Look at the red circle. They are options for payment of TDS/TCS. Select challan no. 281.

After clicking on challan 281, you can see following skin.

Now , you may question how to fill challan No. 281. I have narrated below :

- Deductee code: Select code 0020 if you have deducted TDS of company deductee. select code 0021 for other deductee. I hope you know what is the meaning of deductee. The person from whose payment you have deducted TDS is deductee and you are deductor.

- Write your TAN no. and select assessment year. For payment of TDS for september, 2014, a.y. is 2015-16 and so on.

- Don’t try to write name as it will be displayed on confirmation screen.

- Contact information: Fill column of the address ,mobile number and email id.

- Type of Payment: Select 400 code only if TDS demand is raised by department or shown on TRACES ‘ dashboard. In any other case, select code 200.

- Code of payment: Select code of nature of payment as per payment you have made. Suppose you have deducted TDS on payment to contractor, select code 94C.

- Select bank from which you want to pay TDS. You must have net banking facility active in your bank account.

- Write the captcha code and click on proceed.

Step 3: Make the payment:

Now, you can see confirmation screen, check all the information and click on submit. You will be redirected to net banking facility. Enter your ID and password of net banking facility and make the payment.

Step 4: Save the receipt :

On successful payment of TDS , receipt will be generated. Save it as it is proof of TDS payment made.

Step 5: Check the status of tds payment:

After week, you can check status of your tds payment from following link.

OLTAS link You can check status of challan from your TAN number or from CIN number.

Helpline of NSDL:

You can get help from TIN call center by dialing number 020 2721 8080 or email at e-tax@nsdl.co.in

OFFLINE payment of tds:

If you don’t want to make online payment, you can download challan 281 from the end of the article.

How to make offline payment of tds?

Fill the details in the challan explained above and submit it to your nearest authorized bank. The bank will return you receipt (counterfoil) of successful payment.

Other important points:

- Use separate challan for company and non company deductee.

- Use separate challan for different payment (different accounting code of payment)

- For company and auditable parties, it is mandatory to pay tds online.

I hope now you can easily make online or offline tds payment.

we have taken the office on rent , now rent payment will be more than 1.80 lacs pa , we would like to know how much tds will be deduct on rent either 2% or 10%

Sunilji,

Rate is 10% for office rent.