You can track income tax refund status online very easily.I hope you have filed your return on time and now it is time to get income tax refund if your tax liability is less than tax deducted via TDS/TCS. . In this post You can learn how to check tds refund status online and meaning of various refund status on income tax site.

How to check income tax refund status online?

Income tax refund status can be track through income tax e filling site.

For it, Go to following link

Click on LOG in link (If you have filed return with help of CA, ask him for log in password, id is your pan number.)

Learn how to registered on income tax e filling site

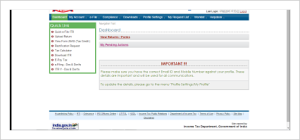

After entering log in details , you can see following skin

Go to my account< refund/demand status.

You can see refund status for each assessment year, reason of status and payment mode of refund.

Who can see tax refund status?

The person who has e filled (online return filling) of income tax return. The person who has filed income tax return offline cannot track refund status online. You have to communicate with AO to know about your income tax status.

Meaning of different status at refund status online tracking:

Use follow chart to understand meaning of tds refund status/income tax refund status.

| Refund status | Meaning | Steps to be taken |

| Refund returned | Refund is issued but could not processed due to wrong bank details. | Go to My account < refund re issue request and enter your bank account right details. |

| No e filling has done for this assessment year | You have not filed your return online orYou have filed your return offline – paper mode | File return online now using tax masala ‘s CA assisted online return filling services.File Now. Starting from Rs. 499. |

| Not determined | Your income tax return has not been processed by tax department and refund is not determined. | Check after a month. |

| Refund paid | You have received your refund. | Check your bank account statement to track refund amount.If you have not received refund, contact your bank immediately or SBI. Contact details of sbi is given at the end of the post. |

| Contact jurisdictional assessing officer | It means that income tax department needs further clarification or information with regards to your refund. | Contact your assessing officer . You can know your jurisdiction from following link. |

| Demand determined | Your tax demand is determined for the assessment year instead of tax refund. | Check that you have filed accurate details in refund.Study intimation received to you by it department. File revised return or rectification request. You can get help of tax masala’s online CA service which can help you to file your rectification request. |

Income tax refund processing takes 6 to 8 months from the date of income tax e filling. If you have filed all the data and TDS details accurately, you can get refund in bank account. If you are still filling problems in getting refund, You can avail our online tax return services. Click here to start. The Refund service starts from Rs. 499.

Income tax refund matters contact details:

You can contact SBI on

Email : intro@sbi.co.in

Number: 1800 425 9760

Address:

Cash management Product,

state bank of india, SBIFAST,

31 Mahal industrial estate,

Off mahakali Caves Road,

Andheri east , Mumbai. 400093.

If you have any question for income tax refund status online (tds refund status online), ask me by comments. Don’t forget to share this article with your friends on social media. Thanks for reading.